Uprova values ensure that equal opportunity is provided to enter the lending market without any predatory products. Everyone needs a clear path to safely lend their products and better financial health, regardless of their credit history. Not only Uprova but there are many such alternatives that just like Uprova provide the opportunity. Let us know everything about Uprova and its alternatives in one place.

What Is Uprova?

Uprova is a company offering instalments and tribal loans for borrowers with various types of credit. Uprova works through an online application and can provide funds within half an hour. The tribal loans aspect is note-worthy as these offerings are from lenders owned by Native American tribes, operating under their jurisdiction.

Also Read N: What Is The DnD Constitution? Impact On Hit Points

Review On Uprova

2024 has been a vocal year for Uprova customers, sharing their journey and experiences with the service.

- Uprova is generally easy to get approved and does not require a particular credit score.

- Customers can usually access cash quickly, even if they do not have an excellent credit rating.

- Even among a wide range of borrowers, including someone with poor credit ratings, Uprova loans are easily accessible to them.

- In many of the cases, the application process to get a loan from Uprova is simple and people receive their money swiftly.

- Funding process is within 30 minutes.

- Uprova, unlike other alternatives, often has significantly higher interest rates than alternative loan options.

- Uprova is not regulated by state laws, which might lead to a loss of customer protection.

- But as we know the loans provided have high interest rates and fees, the people who borrowed money from Uprova or any other Tribal loans may find it difficult to Pay back on time, potentially leading to a cycle of debt.

Also Read P: What Is Crotch Rocket Meaning And Why Buy It?

10 Alternatives Of Uprova

There are various platforms through which we can take loans, according to the needs of the borrower. It is recommended to go through all the alternatives given below, highlighting what sets them apart.

1. Fund Finance

It offers a wide range of loan options, having extensive information to guide the borrowers. Their main objective is to educate users ensuring informed decision-making, catering to those who value clarity and detail in their financial attempt.

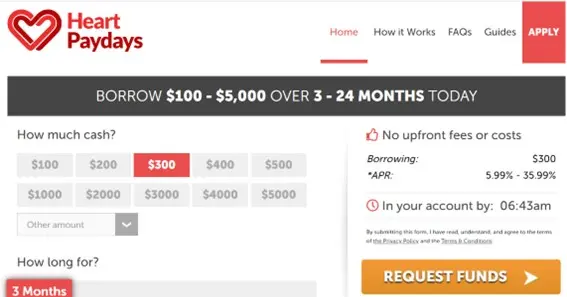

2. Heart Payday

Its services are towards a broader audience, including those with less-than-ideal credit scores. Its fast approval process and openness to working with a wide range of credit histories make it an accessible option.

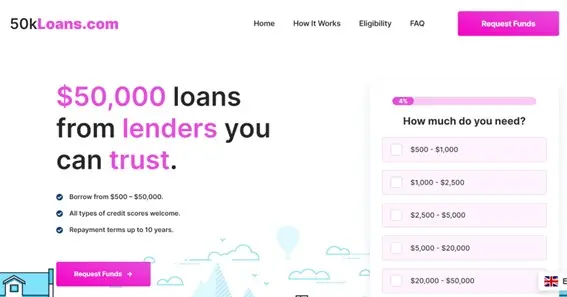

3. 50k Loans

50k loans offer substantial loan amounts. Their speciality in facilitating larger loans positions them as an ideal choice for borrowers facing considerable expenses or projects, providing a financial lifeline.

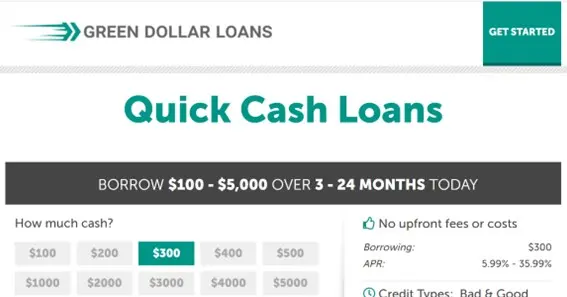

4. Green Dollar Loans

It differentiates itself with a focus on substantiality, offering eco-conscious loan options. Their commitment to transparent terms coupled with an eco-friendly approach appeals to customers who are concerned about their environmental impacts making them a unique option.

5. Flexwage

With the Flexwage app, you can easily keep track of all your bills in one place. You only need to make a username and password and confirm your account to use this app. This app makes it easy to view accounts, make payments to pay bills, and do a lot more. We trust them, even though they don’t have any users yet, as long as they keep working on the app.

6. Empower

Empower Finance made the free Instant Cash Advance app for managing money. By using this app, people can get up to $250 in cash advances with no interest. You can use a lot of the great deals it has every week. These promotions provide online shoppers with up to 10% cashback and savings. This programme also includes 24/7 alerts to check your expenditure and prevent you from buying unnecessary items.

7. FloatMe

The FloatMe company made the free app Payday Cash Advance. The primary purpose of this programme is to save money, track cash, and minimise bank fees. You must link your bank account to utilise this app. People can get their due wages this way without having to ask their boss to send their paychecks faster. Additionally, you may track your income and expenses and where you spend your money.

8. Klover

Kliver Holdings made Cash Advance Instant, a free app for getting cash advances. People can get their already-earned money right away for free with this app. Linking your bank account to the app is all it takes to sign up and use it. The Klover app lets you get cash right away and also see how much money you have left. Also, it allows people to keep track of how much they pay each month by area.

9. CashNetUSA

CashNetUSA is a free money management software by Enova International, Inc. This software aims to simplify credit application and management. It offers monthly loans as well as handling the line of credit. It also lets people ask for refunds, see how much money they have left, and make payments. You can get updates, account state reminders, and notes on your phone’s calendar with this app.

10. Affirm

To make shopping online more accessible and more relaxing, Affirm makes deals go more smoothly. There are many shopping apps, but you might need to help to understand them because they are too hard to understand and have annoying fees. On the other hand, Affirm’s goal is to be honest and give customers what they pay for. You can pick shops on this app to get everything you need.

Conclusion

Engaging with any financial service requires thorough research and consideration, making sure that the chosen lender is beneficial to you according to your needs. Uprova stands out with its user-friendly application process and many other pros. It has a lot of good reviews but in terms of the borrower, he or she must analyze the terms and interest rates of Uprova or any other alternatives before moving forward with the process.

FAQ

How Do I Contact Uprova?

You can contact Uprova through phone, email, or mail. Check its website for specific contact information. The company is available on all weekdays excluding federal holidays.

Does Uprova Check Your Credit?

Uprova might check your credit score. However, it offers loans to borrowers with a variety of credit scores.

Is Uprova A Payday Loan?

No, Uprova offers fixed-term instalment loans. Unlike payday loans which have short terms and are designed to be paid back in single installments, installment loans tend to have multiple installments.

What Is The Credit Limit For Uprova?

The credit limit of Uprova is between $300 and $5ooo

What Should Be Your Credit Score To Get Loan From Uprova?

600 credit score

We have covered all the below topics in the above article

Uprova

Uprova meaning

Uprova definition

Uprova explanation

Sources